Automating GST Reconciliation in Microsoft Dynamics 365 Business Central with NB India GST Add-on

Introduction: Understanding the Fynamics GST Reconciliation Integration

GST Reconciliation is a sophisticated feature designed to identify and categorize transactions that are matched or unmatched with GSTR-2A Reconciliation and Purchase Register Data. In the Fynamics ecosystem, unlike straightforward E-Invoicing and E-Way Bill processes, GST Reconciliation is not a simple end-to-end API call but rather a complex, multi-step process that requires accuracy and intelligence.

Businesses using Microsoft Dynamics 365 Business Central GST capabilities can now automate this complex process with the NB India GST Business Central integration, ensuring accurate Input Tax Credit (ITC claims) and stronger compliance.

The Four-Stage GST Reconciliation Process in Microsoft Dynamics 365 Business Central

The GST reconciliation process in Microsoft Dynamics 365 Business Central through the NB India GST App involves four critical stages, each designed to ensure comprehensive data validation, accurate matching, and complete compliance coverage:

Stage 1: Send Purchase Register Data

Purpose and Significance

To initiate the GST Reconciliation process effectively, Fynamics requires comprehensive Customer’s Purchase Register Data that includes all relevant purchase transactions for the specified period. This foundational step ensures that the reconciliation process has access to complete and accurate purchase information.

Technical Implementation

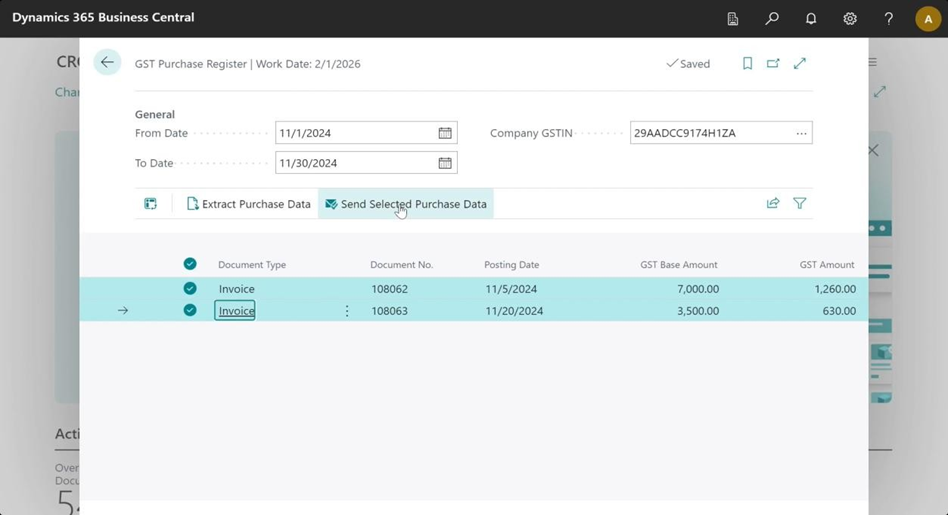

To send the Purchase Register Data from Microsoft Dynamics 365 Business Central to Fynamics, a specialized API call is triggered from the NB India GST App. This API call is initiated from a customized, user- friendly page called “GST Purchase Register” which systematically collects all the Purchase Register Data for a user-selected period.

Data Collection Features

The GST Purchase Register page provides: – Flexible period selection capabilities – Comprehensive data validation before transmission – Real-time status updates during data transfer – Error reporting and resolution guidance – Audit trail maintenance for compliance purposes.

Data Validation Process

Before transmission, the system performs: – Format validation to ensure GST compliance – Completeness checks for mandatory fields – Duplicate detection and handling – Cross- reference validation with existing records – Error flagging and resolution recommendations.

Stage 2: Pull GSTR-2A Government Data via API

The Government Data Retrieval Process

Once Fynamics has successfully obtained the Purchase Register Data through the process described in Stage 1, the next critical step involves retrieving the GSTR-2A Reconciliation data from the government portal. This government-filed data represents the official record of transactions as reported by suppliers to the GST authorities.

Authentication and Security

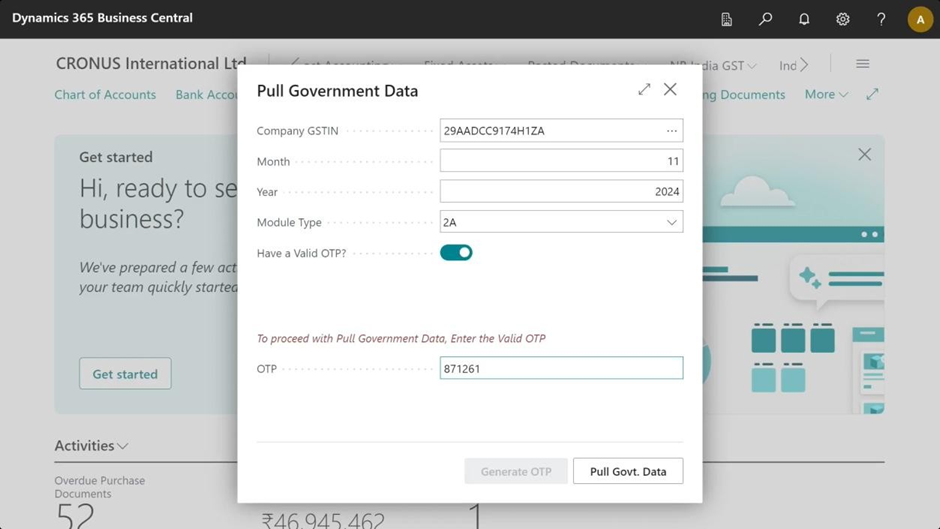

To fetch the GSTR-2A data securely, an API call is made through the NB India GST App with robust authentication mechanisms. This call is initiated from a specialized, customized page titled “Initiate Pull Government Data,” where users can: – Select the desired period range for data retrieval – Provide secure OTP authentication for verification – Monitor the progress of data retrieval in real-time – Handle authentication failures and retry mechanisms. This ensures safe GST compliance management solutions within Microsoft Dynamics 365 Business Central GST.

OTP Verification Process

The API call will only be successful if the OTP (One-Time Password) provided is valid and current. The OTP is a secure, time-sensitive password sent to the phone number officially registered with GSTIN, ensuring that only authorized personnel can access sensitive tax data.

Data Security and Compliance

The government data retrieval process includes: – Encrypted data transmission protocols – Secure storage of retrieved information – Access control and audit logging – Compliance with data protection regulations – Regular data refresh and synchronization.

Stage 3: Perform Invoice Level Match GST

The Reconciliation Matching Engine

Once Fynamics has successfully obtained both the Purchase Register Data and GSTR-2A data, the system proceeds to the critical reconciliation matching phase. The Automated GST Reconciliation engine compares Purchase Register Data with GSTR-2A Reconciliation results. This sophisticated process compares the two datasets to identify matches, discrepancies, and potential issues.

Technical Execution

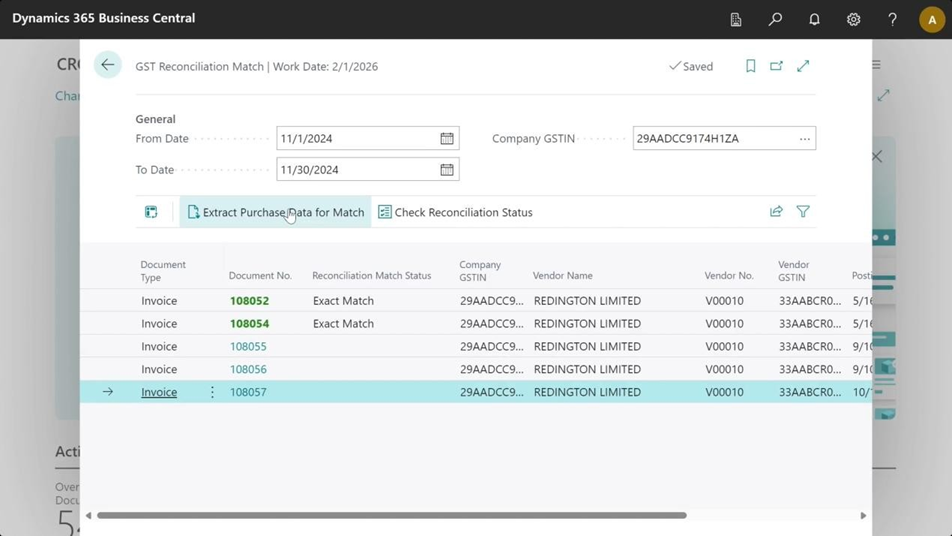

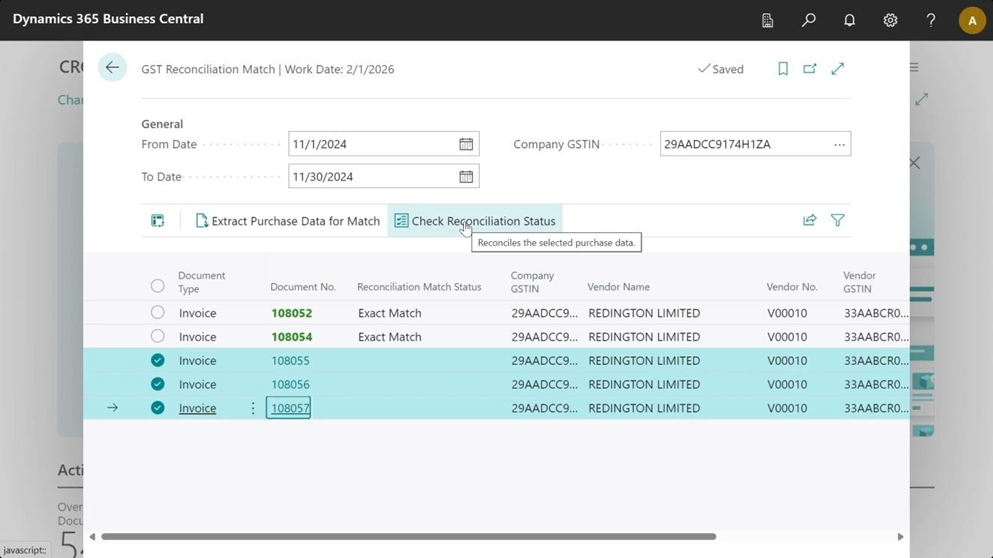

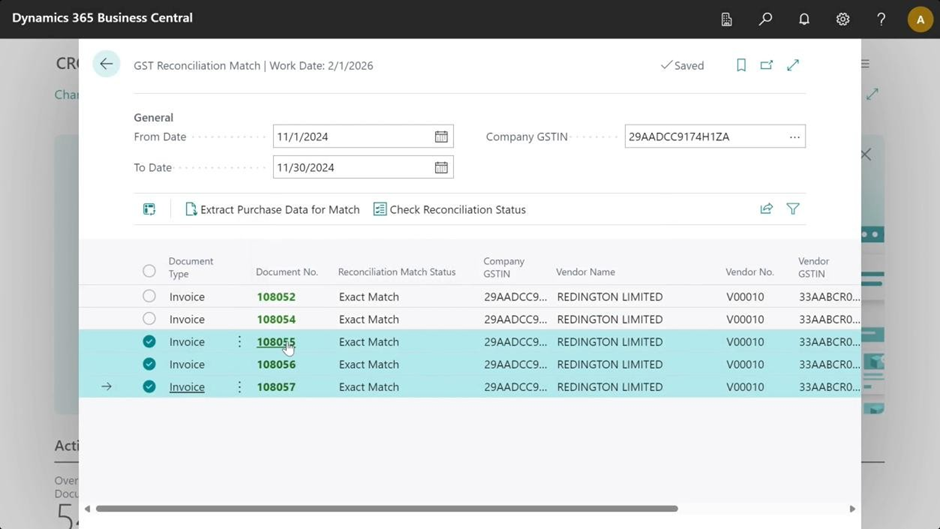

To perform the comprehensive Reconciliation Match from Microsoft Dynamics 365 Business Central, a specialized API call is triggered from the NB India GST App. This API call is initiated from a customized page titled “GST Reconciliation Match” which systematically processes all the Purchase Register Data that has already been successfully transmitted to Fynamics.

Matching Algorithms and Criteria

The system employs advanced matching algorithms that consider: – Invoice numbers and document references – Supplier GSTIN and identification details – Invoice dates and transaction timing – Tax amounts and rate classifications – Item descriptions and HSN codes – Multiple tolerance levels for amount variations.

Reconciliation Results and Categories

The matching process categorizes transactions into:

- Perfect Matches: Complete alignment between purchase and government

- Data Partial Matches: Minor discrepancies that may require investigation

- Unmatched Purchase Records: Transactions in books but not in GSTR-2A

- Unmatched Government Records: GSTR-2A entries without corresponding purchase records

- Disputed Transactions: Significant discrepancies requiring manual review

The system also provides intelligent recommendations GST reconciliation for corrective actions, prioritization, and compliance impact analysis.

Intelligent Recommendations

Based on the matching results, the system provides: – Automated action suggestions for each transaction type – Risk assessment for unmatched items – Prioritization of items requiring immediate attention – Compliance impact analysis – Resolution workflow guidance.

Stage 4: Fetch Government Not Found Invoices in D365 BC

Addressing Data Gaps and Discrepancies

Post-reconciliation analysis often reveals that certain GSTR-2A documents may exist in the government database without corresponding matching Purchase Data in the business records. These discrepancies can occur due to various operational reasons, including suppliers missing to file Purchase Data accurately, even though the transaction information is available and verified on the Government Portal.

Comprehensive Gap Analysis

To address these significant data gaps systematically, the NB India GST App includes a specialized, customized page titled “Fetch Government Not Found Invoices” that initiates a targeted API call. This sophisticated call retrieves specific GSTR-2A data for a defined timeframe, focusing specifically on documents that haven’t undergone reconciliation or lack corresponding purchase records. This helps businesses using D365 Business Central GST compliance identify gaps caused by supplier delays or filing errors.

Benefits of Automated GST Reconciliation in Microsoft Dynamics 365 Business Central

By integrating Fynamics GST Reconciliation with Microsoft Dynamics 365 Business Central GST, businesses can:

- Automate GSTR-2A reconciliation process in Microsoft Dynamics 365 Business Central

- Ensure accurate Input Tax Credit (ITC) claims

- Reduce manual effort with GST Automation in Business Central

- Improve compliance with GST compliance management solutions

Final Thoughts on Automated GST Reconciliation in Business Central with NB India GST

The automation of GSTR-2A reconciliation in Microsoft Dynamics 365 Business Central represents a significant advancement in GST compliance management solutions. By leveraging sophisticated technology platforms like Fynamics integrated with the NB India GST App, businesses can achieve unprecedented levels of accuracy, efficiency, and compliance in their GST operations.

This comprehensive Four-Stage GST Reconciliation Process ensures that organizations maintain complete control over their Input Tax Credit (ITC) claims while meeting all regulatory requirements. With its intelligent matching algorithms, automated data retrieval capabilities, and detailed reporting features, GST Automation in Business Central transforms reconciliation into a strategic advantage rather than a compliance burden.

As GST regulations continue to evolve and become more complex, Automated GST Reconciliation within D365 Business Central GST compliance will become increasingly critical for businesses. It not only streamlines how companies handle reconciliation but also helps them sustain competitive advantages while ensuring full compliance with India’s dynamic tax landscape.

At Cetas, we’ve designed this NB India GST add-on for Business Central to simplify and automate your entire GST reconciliation process. Contact us today to learn how we can help your business achieve smarter GST compliance, reduce manual effort, and gain better control over your tax data.

Credit: Aneez Fathima, our Senior Business Central Functional Consultant